Contact Information

Financial Assistance

Prevention Assistance

Due to limited funding availability for Rent and Utility assistance, the application portal will reopen on a limited basis effective July 21st, 2025. Specific eligibility criteria will be used as outlined in the chart below. Only past due rent and utilities will be eligible for assistance.

Mortgage assistance is not available at this time.

A submitted application is not a guarantee of assistance.

Financial Assistance is offered for Rental or Mortgage and/or Utility services through the Prevention Assistance Program for qualified Seminole County residents, pending funding availability. A household must have experienced a documented, financial hardship within the last 90 days and have proof of the ability to sustain and show on-going management. Eligible households can receive assistance once every two years. If any member of the household received assistance in the last two years, the household will not be eligible. Exception for elderly, fixed income households these households can receive assistance every 12 months as long as the household still meets eligibility requirements. This is a one-time assistance, and the amount of assistance is determined by the documented loss but will not exceed three months of past due rent or $5,000, whichever is less. Section 8, HUD, TBRA, and subsidized Housing Recipients are not eligible for rental/mortgage or utility assistance.

Emergency Assistance is not provided, and the processing time can be several weeks.

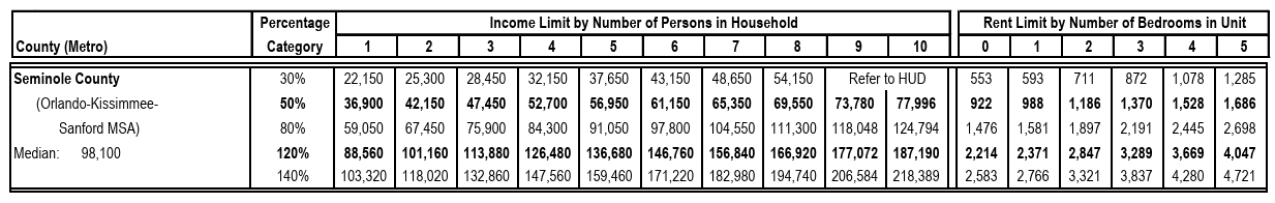

The following Income/Rent limits will be used in determining eligibility:

Interested applicants must complete an online application and provide the required documentation.

Applicants without computer and/or scanner access may use the Application Center located at 520 West Lake Mary Boulevard, Suite 100 Sanford, FL 32773. The Application Center is open Monday through Friday from 8:30 am to 4:30 pm with the exception of county observed holidays. The application center is self-serve and available on a first come, first serve walk-in basis.

For more information, please contact our office at 407-665-2300.

For additional community resources please contact the United Way by dialing 211 or 407‑839‑4357.

Deposit Assistance

Seminole County Community Assistance will reopen the application portal Deposit assistance on July 3rd, 2025.

A submitted application is not a guarantee of assistance.

The Community Assistance Deposit Program is available to households experiencing homelessness or are in imminent danger of becoming homeless due to court eviction, non-renewal of lease, or foreclosure that occurred in Seminole County. Funds can be used to pay for security and utility deposits which include the following items: rental security, key deposit/fee, cleaning deposit/fee, utility deposits and connection fees for electricity, water, sewer, trash, or gas.

Assistance cannot be provided if the household has signed a lease prior to receiving approval from the county. This program provides one-time assistance and does not provide ongoing monthly rental payments. Household must have a gross annual income at or below 120% Area Median Income. If approved, the monthly rental amount cannot exceed 50% of the household’s monthly income and cannot exceed the Fair Market Rent for Seminole County. Assistance is available to eligible households once every three years.

Emergency Assistance is not provided, and the processing time can be several weeks.

Interested applicants must complete an online application Website and provide the required documentation.

Applicants without computer and/or scanner access may use the Application Center located at 520 West Lake Mary Boulevard, Suite 100 Sanford, FL 32773. The Application Center is open Monday through Friday from 8:30 am to 4:30 pm with the exception of county observed holidays. The application center is self-serve and available on a first come, first serve walk-in basis.

For more information, please contact our office at 407-665-2300.

For additional community resources please contact the United Way by dialing 211 or 407-839-4357.

80% of Area Median Income (as of 4/01/2025)

| 1 Person | 2 Persons | 3 Persons | 4 Persons | 5 Persons | 6 Persons | 7 Persons | 8 Persons | 9 Persons | 10 Persons |

|---|---|---|---|---|---|---|---|---|---|

| $59,050 | $67,450 | $75,900 | $84,300 | $91,050 | $97,800 | $104,550 | $111,300 | $118,048 | $124,794 |

Dental Assistance

Applications for the Seminole County Community Assistance Dental program are currently CLOSED due to expended funds. The program will reopen in October 2025.

The Community Assistance Office offers Dental Assistance to income eligible adults (ages 18 and older) that reside in Seminole County and not within the city limits of Sanford. The purpose of the Dental Assistance program is to provide financial assistance with the cost of cleanings, deep cleanings, extractions, fillings, partial/full dentures, referral costs, x-rays, root canals and crowns. Implants, orthodontics, and cosmetic procedures are not eligible.

Submitted pre-applications will be placed on a waiting list and processed on a first come, first complete basis pending funding availability with priority given to elderly, fixed income households and households receiving permanent housing services from Seminole County Community Assistance.

* Please note that funding is not available for residents of the City of Sanford.

* If approved, the dental office used for services must be located in Seminole County, but not within the City Limits of Sanford.

Applicants without computer and/or scanner access may use the Application Center located at 520 West Lake Mary Boulevard, Suite 100 Sanford, FL 32773. The Application Center is open Monday through Friday from 8:30 am to 4:30 pm with the exception of county observed holidays. The application center is self-serve and available on a first come, first serve walk-in basis.

For more information, please contact our office at 407-665-2300.

For additional community resources please contact the United Way by dialing 211 or 407-839-4357.

80% of Area Median Income as of 4/1/2025 based on household size

Eligibility Criteria

Household must reside in Seminole County and not within the city limits of Sanford.

Household income must be at or below 80% of the current Area Median Income.

The person applying for assistance must be at least 18 years of age or older.

Required Documentation

- Valid Florida ID or valid Florida Driver’s License for all adults (18yrs and older).

- Birth certificates for all minor children in the household.

- Most recent 90 days documentation of income for the household.

- All pages of the most recent bank account/pay card statements for the household. This includes accounts for minor children.

- Valid Lease Agreement, Mortgage statement, or proof of homeownership.

- Homeless Customers will complete the Homeless Affidavit Form.

- Dental referral written by a licensed Central Florida dentist within the last 6 months.

Dental Assistance forms

Seminole County Release of Information Required – signed by all household members, age 18 and older

Verification of No Child Support Income Form - use if minor children do not reside with both parents and support is not being received

Verification of No Monthly Income Form use if an adult household member does not have any form of income

Verification of No Financial Account Form – use if an adult household member does not have a financial account or pay card account

Proof of Income Monthly Profit & Loss Statement – use if any adult household member is self-employed. Complete one form for each of the most recent six months

Homeless Affidavit use if the household is homeless

How Much Assistance Can I Receive?

Eligible adult household members can receive up to $3,000 towards eligible dental services. Individual will be responsible for remaining balance if the cost of the services exceeds $3,000.

Prevention Assistance

Applicants must meet all criteria to be considered for the Financial Assistance Program. Eligibility requirements include:

- Reside in Seminole County, Florida

- Experienced an unexpected, documented financial hardship in the 90 days prior to application submission date

- Be responsible for paying rent and/or utility on the residence

- You are a U.S. Citizen or permanent legal resident (Adult applying for the assistance must be a U.S. Citizen or permanent legal resident)

- Household must have income of at least 50% of the monthly rent and utility. If the household does not have income or has income that is less than 50% of the rent and utility, the household will not be eligible for assistance.

- Household gross income must be at or below 120% Area Median Income

- Household does not receive Section 8, TBRA or any subsidized housing assistance

120% of Area Median Income and Rent Limits (as of 4/01/2025)

1 Person | 2 Persons | 3 Persons | 4 Persons | 5 Persons | 6 Persons | 7 Persons | 8 Persons | 9 Persons | 10 Persons |

$81,120 | $92,640 | $104,280 | $115,800 | $125,160 | $134,400 | $143,640 | $152,880 | $162,120 | $171,384 |

Assistance is determined by the documented loss but will not exceed three months of past due rent/mortgage and/or utility or $5,000, whichever is less.

If the household is not past due, assistance will be determined by the documented loss and will not exceed one month of rent/mortgage and/or utility assistance or $5,000, whichever is less.

Who is considered a household member?

A household member is anyone, adult or child, that resides in the home. This also includes anyone listed on the lease or mortgage.

What is considered income?

Income is any funds, both earned and unearned, that are received in the household.

Examples of unearned income include Social Security benefits, pensions, child support/alimony and unemployment compensation. Documentation required: Current Social Security award letter, current pension letter, court order for child support/alimony or print out from Clerk's office or state system, unemployment determination letter and disbursement list.

Earned income includes wages from employment and self-employment. Documentation required: all pay stubs for wages paid in the 90 days prior to application submission. For self-employment/1099 contractors, the most recent tax return and 6 months profit/loss statements.

What is considered self-employment?

You are considered self-employed if you operate a business or if you are a contract employee for a company. A contract employee does not have taxes withheld by the company they are working for and will receive a 1099 at the end of the year instead of a W-2.

What is an asset?

- Bank accounts (checking, savings)

- Pay Cards

- Stocks or bonds

- Whole Life Insurance

- Mutual funds

What is a hardship?

A hardship is an unexpected, documented loss of income or expense incurred by the household in the 90 days prior to submitting the application.

What are some examples and the documents for my hardship?

- Job loss due to a circumstance out of your control

- Letter from employer verifying last date worked and reason for termination on signed company letterhead or copy of unemployment approval with payment disbursement list.

- Reduction in employment hours by employer (not a result of client actions/requests).

- Written documentation from employer on letterhead signed stating effective date of reduction and reason for reduction with pay stubs within the last 6 months to verify statement from employer.

- Family breakup can be considered if the previous household member's name is listed on the lease.

- Written and signed verification from landlord that person is no longer at residence and date they left the household or verification of incarceration (in jail) and documentation that person was a contributing member of the household -example: recent check stubs. *Note: previous resident must have been on the lease agreement and have had income for loss to be considered.

- Expenses due to taking guardianship of a minor child(ren) due to abuse/abandonment or neglect.

- Court Order with customer and child's name showing date order became effective and receipts showing additional expenses paid out for child. Only expenses for necessities will be considered.

- Documented on-going loss of child support payment.

- Current child support print out showing gap in payments

- Unemployment benefits approval that results from appeal by customer (must show appeal letter and supporting documentation).

- Unemployment appeal decision letter showing you have been approved for benefits.

- Out of work due to medical -without pay or reduced pay

- Medical excuse from licensed physician stating dates out of work under doctor's care and expected date of return (no medical records accepted).

- Unexpected car or home repairs- routine maintenance not considered (Roof replacement and Heating/Cooling system replacements will be considered)

- Receipt in customer's name from licensed vendor within the last 90 days (car repairs also require current car registration)

- Lapse in payment for extended benefits for unemployment, short term disability or workmen's compensation-*Cannot be due to customer's actions

- Print out or letter from agency verifying gap in payments and reason

- Seniors or disabled customers that receive the unexpected garnishment of multiple Medicare per diems from their social security check.

- Social Security Awards letter verifying the lump sum Medicare Premium being taken out

- Consideration may be given for those employees whose hours normally and routinely fluctuate; such as, pool employees, temp or part-time personnel, commission sales personnel or home health care workers only once and with approval from the Case Manager Supervisor but not in the future if client continues to work such employment.

- Must have documentation from employer on signed company letterhead indicating the start date and the situation, such as temporary assignment ending, layoff, decrease in hours or sales etc.

- Burglary/Theft of funds

- Must have police report filed within 30 days of incident occurring

- Unexpected expenses/or loss of income due to death of immediate family member (spouse, domestic partner, father, mother, child, siblings, grandchild, grandparents).

- Receipt from funeral home showing amount paid or receipt for plane ticket/travel expenses along with death certification, obituary, and/or funeral program for deceased

- Fire/Arson resulting in relocation and/or loss of income/property *Note: Cannot assist if losses covered by homeowners/renter insurance

- Written report from Fire Marshall indicating occurrence was at the household

- Increase in rent of 10% or more per month

- Copy of previous lease and copy of new lease that reflects the increase in monthly base rent *Assistance is limited to one-month rent and utilities.

- Increase in mortgage escrow of 10% or more per month

- Copy of previous mortgage statement and copy of new mortgage statement that reflects the increase in monthly escrow payment. *Assistance is limited to one-month mortgage and utilities.

- Elderly (65+) households on fixed income

- Applicant must be 65 years of age or older, responsible for rent or mortgage payment on the residence and all adults in the household must be on a fixed income (i.e. Social Security, retirement, pension). *Can receive up to two months of assistance, not to exceed $5,000.

What is not considered a hardship?

- Job loss due to household members own actions.

- Customers showing sufficient income even with a loss of income.

- Quitting employment.

- Over drawn bank accounts/ exhausting savings accounts.

- Family members ceasing financial assistance.

- Arrests, payment of legal fees, probation, or traffic violations.

- Social Security payments ending and/or stopping due to failure to report income, over payments, or benefits ending due to children reaching age limit.

- Unemployment ending due to having exhausted available benefits

- Higher utility bills

- Salaries that are paid "under the table "or not filed on yearly taxes.

- Loans/credit debt or any garnishment of wages due to a loan or debt.

- Gaps in financial aid payments or delays are not considered a loss.

- Loss of income due to gambling or losses in the stock market.

- Customers living off of credit cards that are "maxed out" or interest rate increases on charges or cash advances will not be considered.

- Increase in cost of goods and services.

How do you provide proof of reduction in hours if you are self-employed?

Self-employed residents can provide 6 months of a profit/loss forms to prove their reduced income. Additionally, residents will need to provide documentation of the reason for the reduction (i.e.. Doctors note, accident report, auto repair receipt).

If approved, how do I receive the funds?

Funds will be distributed directly to your landlord or mortgage company and utility company(ies).

Is this the Emergency Rental Assistance Program?

No. The county has fully expended the Emergency Rental Assistance funds that were received to assist households that were impacted by COVID-19.

What if my application is incomplete?

Applications will be automatically rejected if documents are missing, falsified or illegible.

Do I have to pay the money back?

No. Residents do not have to pay back the money.

If my application is approved, will I get a notification?

Yes, your case manager will provide information regarding your approval

The following documents are required to complete and submit the application:

- Head of household (applicant) must be a U.S. citizen or legal U.S. resident

- Proof of Seminole County residency. (Current complete rent/lease agreement or mortgage statement. If lease is expiring within 60 days of the application submission date, a lease renewal will be required).

- Valid Florida Photo I.D. (Driver's license or I.D. card). For all adults age 18 and older in household. Please note: Out of state IDs, Passports, Military ID are not acceptable replacements for a Florida Driver's license or I.D. card

- U.S. Birth Certificate for all children in the household (a valid U.S. Passport, court ordered custody paperwork, school records showing parent and child's name, or immunization records may be substituted if a U.S Birth Certificate is not available)

- Social Security card for all household members

- If any household member is not a US citizen, you must provide a copy of a Valid Permanent Resident Card

- Proof of all income in the household for the past 3 months. (This includes AFDC, Food Stamps, Child Support, SSI, SS, VA, Pensions, unemployment and all employment earnings)

- A Verification of No Monthly income form will need to be completed and notarized by all household members, age 18 or older, that do not have any type of income.

- If self-employed or a 1099 employee, please complete 6 months of monthly profit/loss forms and most recent IRS tax return.

- All pages of the most recent three months bank statement/ pay card statement for all accounts in the household. This includes accounts for minor children.

- A Verification of No Financial Accounts form will need to be completed and notarized by all household members, age 18 or older, that do not have any type of financial account

- Documentation of Financial Hardship that occurred within the 90 days prior to the date the application is submitted.

- Utility Bill water, electric, gas (if requesting utility assistance).

- Other documentation may be requested once your application is reviewed.

Financial assistance forms:

Seminole County Release of Information - Required - Signed by all household members age 18 and older.

Verification of No Child Support Income Form - use if minor children do not reside with both parents.

Verification of No Monthly Income Form - use if adult household member does not have income.

Proof of Income Monthly Profit & Loss Statement - use if any adult household member is self-employed. Complete 1 for each of the most recent 6 months.

Verification of No Financial Account Form - use if any adult household member does not have a financial account/pay card.

Deposit Assistance

Applicants must meet all criteria to be considered for the Financial Assistance Program. Eligibility requirements include:

- Must provide documentation of either being homeless or in imminent danger of becoming homeless as a result of the inability to pay security and utility deposits when seeking residence in rental housing.

- Homelessness must occur in Seminole County.

- Rental unit must be located in Seminole County.

- You are a U.S. Citizen or permanent legal resident (Adult applying for the assistance must be a U.S. Citizen or permanent legal resident).

- Household gross income must be at or below 120% Area Median Income.

- Monthly rent charges cannot exceed 50% of the household's monthly income.

120% of Area Median Income (as of 4/01/2024)

1 Person | 2 Persons | 3 Persons | 4 Persons | 5 Persons | 6 Persons | 7 Persons | 8 Persons | 9 Persons | 10 Persons |

$81,120 | $92,640 | $104,280 | $115,800 | $125,160 | $134,400 | $143,640 | $152,880 | $162,120 | $171,384 |

Who is considered a household member?

A household member is anyone, adult or child, that resides in the home.

What is considered income?

Income is any funds, both earned and unearned, that are received in the household.

Examples of unearned income include Social Security benefits, pensions, child support/alimony and unemployment compensation. Documentation required: Current Social Security award letter, current pension letter, court order for child support/alimony or print out from Clerk's office or state system, unemployment determination letter and disbursement list.

Earned income includes wages from employment and self-employment. Documentation required: all pay stubs for wages paid in the 90 days prior to application submission. For self-employment/1099 contractors, the most recent tax return and 6 months profit/loss statements.

What is considered self-employment?

You are considered self-employed if you operate a business or if you are a contract employee for a company. A contract employee does not have taxes withheld by the company they are working for and will receive a 1099 at the end of the year instead of a W-2.

What is an asset?

- Bank accounts (checking, savings)

- Pay Cards

- Stocks or bonds

- Whole Life Insurance

- Mutual funds

What is considered documentation of homelessness?

- Court eviction within the last year in Seminole County.

- Foreclosure within the last year in Seminole County.

- Documentation from City of County Code Enforcement stating current housing is substandard or unsafe.

- Notice of Non-renewal from landlord for a unit in Seminole County.

- Residing in a homeless shelter.

- Referral from the Seminole County School Boards Families in Need (FIN) program verifying the household is homeless.

- "Doubled-up" or "couch surfing" with a referral from a local non-profit/homeless services provider verifying the household is homeless in Seminole County.

- Proof the household has been staying in an extended stay hotel/motel for 14 days with a referral from a homeless shelter, local non-profit or agency/church verifying the household is homeless in Seminole County.

If my application is approved, what are the next steps?

- Your case manager will contact you to sign your income certification document and provide you with your approval letter.

- Once you locate a rental unit you will notify the case manager and an inspection will be scheduled.

- A lease cannot be signed until the unit has been inspected and has passed the inspection. If a lease is signed prior to the inspect, assistance will not be provided.

- Once the unit has passed an inspection, the case manager will give approval to sign the lease.

- The case manager will contact the landlord to have an agreement letter signed and obtain a copy of the signed lease.

- If utility deposit is also being requested, you will provide documentation from the utility company indicating the deposit amount.

If approved, how do I receive the funds?

Funds will be distributed directly to your landlord and utility company(ies).

Is this the Emergency Rental Assistance Program?

No. The county has fully expended the Emergency Rental Assistance funds that were received to assist households that were impacted by COVID-19.

Am I able to apply for the Seminole County Assistance program if I previously received assistance from the county under a COVID-19 related program?

You can apply, however, if your household received rental assistance from Seminole County in the past two years you will only be eligible for deposit assistance and not first month's rent. If your household received deposit assistance in the past three years you will not be eligible. This includes any assistance received from the Emergency Rental Assistance Program (ERAP), Emergency Mortgage Assistance Program (EMAP) and the American Rescue Plan Act (ARPA).

What if my application is incomplete?

Applications will be automatically rejected if documents are missing, falsified or illegible.

Do I have to pay the money back?

No. Residents do not have to pay back the money

Assistance is limited to once every three years with a maximum award of $5,000. The funds can be utilized to pay for rental surety bond, security and utility deposits and first month's rent.

The following documents are required to complete and submit the application:

- Head of household (applicant) must be a U.S. citizen or a legal U.S. resident.

- Valid Florida Photo ID for all adults, age 18 and older in the household. Please note: Out of state IDs, Passports, Military ID are not acceptable replacements for a Florida Driver's license or I.D. card

- If any household member is not a U.S. citizen, you must provide a copy of a Valid Permanent Resident Card.

- U.S. Birth Certificate for all children in the household (a valid U.S. Passport, court ordered custody paperwork, school records showing parent and child's name, or immunization records may be substituted if a U.S Birth Certificate is not available).

- Proof of all income in the household for the past 90 days. (This includes AFDC, Food Stamps, Child Support, SSI, SS, VA, Pensions, unemployment, and all employment earnings).

- A Verification of No Monthly income form will need to be completed and notarized by all household members, age 18 or older, that do not have any type of income.

- If self-employed or a 1099 employee, please complete 6 months of monthly profit/loss forms and most recent IRS tax return.

- All pages of bank statement/ pay card statements for all accounts in the household for the last 3 months. This includes accounts for minor children in the household.

- A Verification of No Financial Accounts form will need to be completed and notarized by all household members, age 18 or older, that do not have any type of financial account.

- Documentation of Homelessness

- Seminole County homeless affidavit and

- hotel/motel receipts with verification letter from shelter/agency in Seminole County, or

- court eviction within the last 12 months in Seminole County, or

- foreclosure within the last 12 months in Seminole County or

- notice of lease non- renewal of current lease in Seminole County or

- Documentation of residing at a homeless shelter in Seminole County or

- Referral from Seminole County Public School's Families In Need office.

- Seminole County homeless affidavit and

Financial assistance forms:

Seminole County Release of InformationRequired - Signed by all household members age 18 and older

Homeless Affidavit - Required - Completed and signed by applicant and co-applicant

Verification of No Child Support Income Form Use if minor children do not reside with both parents

Verification of No Monthly Income Form - Use if adult household member does not have income

Proof of Income Monthly Profit & Loss Statement - use if any adult household member is self-employed. Complete 1 for each of the most recent 6 months

Verification of No Financial Account Form - use if any adult household member does not have a financial account/pay card

Other documentation may be requested once your application is reviewed